If you’re anything like me you’ll find January is the time of year we announce to the world that “I’m going to learn a new skill”…and now that it’s February we really ought to make a start.

People have been learning new skills from books for years so it’s nothing new, but to be honest there are some things that are much easier to teach yourself via videos online rather than from a book – playing the guitar, learning to crochet, how to use your online accounting system…the list goes on. However there are a few fabulous skills that are best suited to learning through a book. Books allow you the time to take things in and patiently wait as you get distracted and start daydreaming out of the window (or is that just me?).

Here’s our 5 top skills you need to learn this year…and they are all from books. You’re very welcome.

1. Start making a difference in the world

Getting to Maybe by Frances Westley

Getting to Maybe by Frances Westley

Many of us have a deep desire to make the world around us a better place. But often our good intentions are undermined by the fear that we are so insignificant in the big scheme of things that nothing we can do will actually help feed the world’s hungry, fix the damage of a Hurricane Katrina or even get a healthy lunch program up and running in the local school. We tend to think that great social change is the province of heroes – an intimidating view of reality that keeps ordinary people on the couch. But extraordinary leaders such as Gandhi and even unlikely social activists such as Bob Geldof most often see themselves as harnessing the forces around them, rather than singlehandedly setting those forces in motion. The trick in any great social project is to stop looking at the discrete elements and start trying to understand the complex relationships between them. By studying fascinating real-life examples of social change this book teases out the rules of engagement between volunteers, leaders, organisations and circumstance and harvests the experiences of a wide range of people and organisations to lay out a brand new way of thinking about making change in communities, in business, and in the world.

2. Take control of your finances

The Barefoot Investor: The Only Money Guide You’ll Ever Need by Scott Pape

The Barefoot Investor: The Only Money Guide You’ll Ever Need by Scott Pape

So I’ve just finished reading “The Barefoot Investor’ and I’ve been left feeling…a bit emotional really. One thing that you’ll find different between this book and any other finance book you have read is that getting on top of your finances gives you enormous freedom. Divorced? Made redundant? Want a change of career? Sort your finances by putting in place the ‘set and forget’ steps covered by Scott Pape and you’re halfway there. For many, this book has been life changing.

3. Get ahead in life

Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers by Timothy Ferriss

Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers by Timothy Ferriss

For the last two years, Ferriss interviewed nearly two hundred world-class performers for the podcast, The Tim Ferriss Show. The guests range from super celebs (Jamie Foxx, Arnold Schwarzenegger), athletes (icons of powerlifting, gymnastics, surfing) and legendary Special Operations commanders and black-market biochemists. This book contains the distilled tools, tactics, and ‘inside baseball’ you won’t find anywhere else. It also includes new tips from past guests, and life lessons from new guests. “What makes the show different is a relentless focus on actionable details. This is reflected in the questions. For example: What do these people do in the first sixty minutes of each morning? What do their workout routines look like, and why? What books have they gifted most to other people? What are the biggest wastes of time for novices in their field? What supplements do they take on a daily basis?

4. Learn how to Code

How to Code: A Step-By-Step Guide to Computer Coding by Max Wainewright

How to Code: A Step-By-Step Guide to Computer Coding by Max Wainewright

Become a master coder, with these step-by-step instructions and robot helpers too! How to Code teaches you all the basic concepts, including Loops, Variables, and Selection, and then develops your skills further until you can create your own website . . . and more! Learn how to use Logo, build games in Scratch, program projects in Python, experiment with HTML, and make interactive web pages with JavaScript.

5. Master makeup wizardry

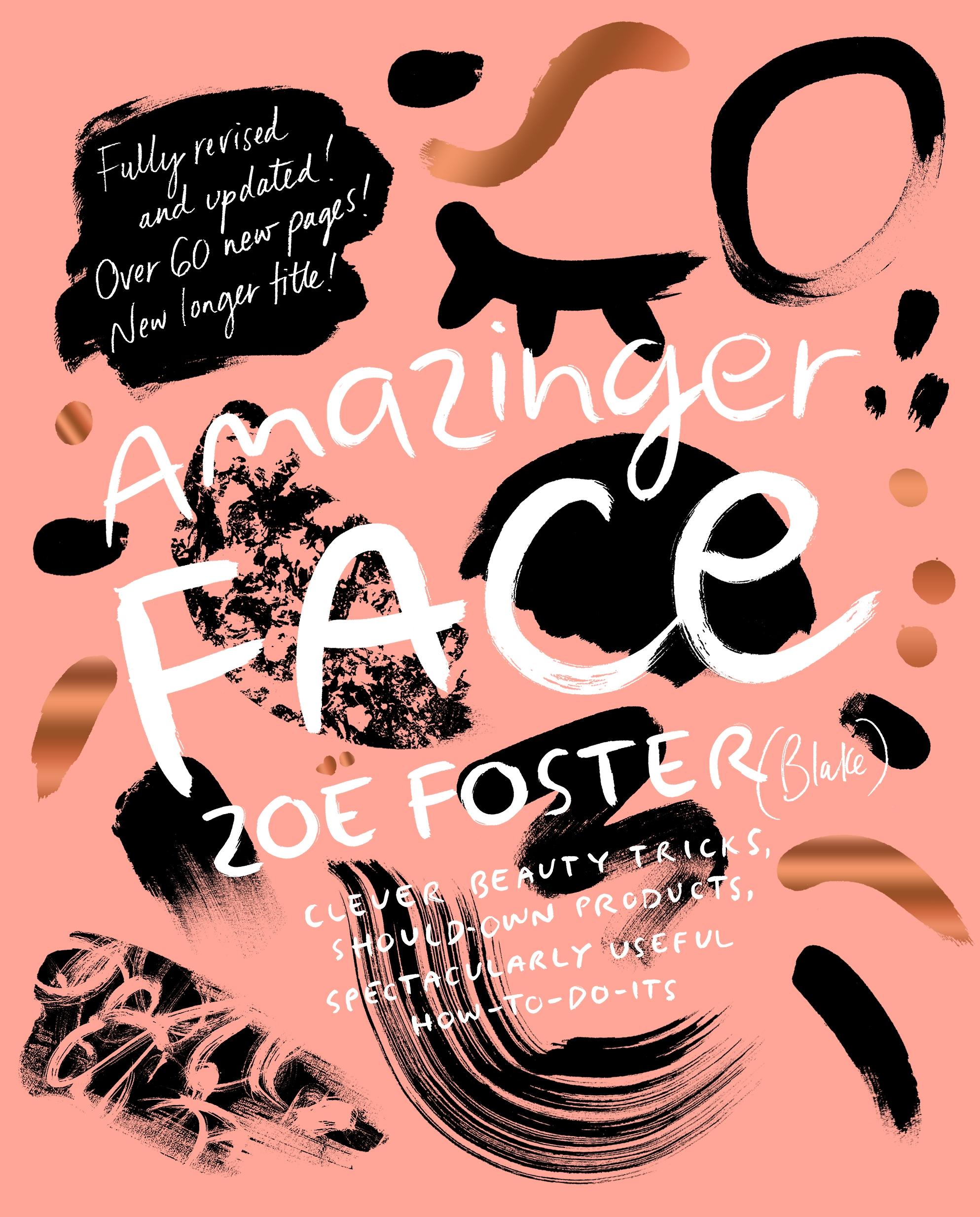

Amazinger Face by Zoe Foster-Blake

Amazinger Face by Zoe Foster-Blake

Sometimes a lady just needs to know the most flattering lipstick for her skin tone, or how to correctly use sunscreen, or a very quick hairstyle to conceal her unwashed hair. And there’s no reason she shouldn’t know which foundation or mascara is best for her, either. All the answers are here, in this top-to-toe beauty extravaganza. Former Cosmopolitan and Harper’s BAZAAR beauty director, and the founder of Go-To skin care, Zoë Foster (Blake) suggests makeup colours and brands for every occasion, useful, practical skin care routines and products for every age, and step-by-step instructions for winged eyeliner, arresting red lips, foolproof tanning, simple up-dos, sexy second-day hair, and much, much more.

And if that wasn’t enough (or if you’re already deciding to renege on the resolution) take a leaf out of Barbara Arrowsmith-Young’s amazing personal story of retraining her brain.

The Woman Who Changed Her Brain: Revised Edition by Barbara Arrowsmith-Young

The Woman Who Changed Her Brain: Revised Edition by Barbara Arrowsmith-Young

Barbara Arrowsmith-Young was born with severe learning disabilities that caused teachers to label her slow, stubborn — or worse. As a child, she read and wrote everything backward, struggled to process concepts in language, continually got lost, and was physically uncoordinated. She could make no sense of an analogue clock. But by relying on her formidable memory and iron will, she made her way to graduate school, where she chanced upon research that inspired her to invent cognitive exercises to “fix” her own brain.

The capability of nerve cells to change is known as neuroplasticity, and Arrowsmith-Young has been putting it into practice for decades. With great inventiveness, after combining two lines of research, Barbara developed unusual cognitive calisthenics that radically increased the functioning of her weakened brain areas to normal and, in some areas, even above normal levels.

Happy Learning!